who pays sales tax when selling a car privately in michigan

Buying a car or any other motor vehicle is a taxable transaction. To calculate how much sales tax youll owe simply.

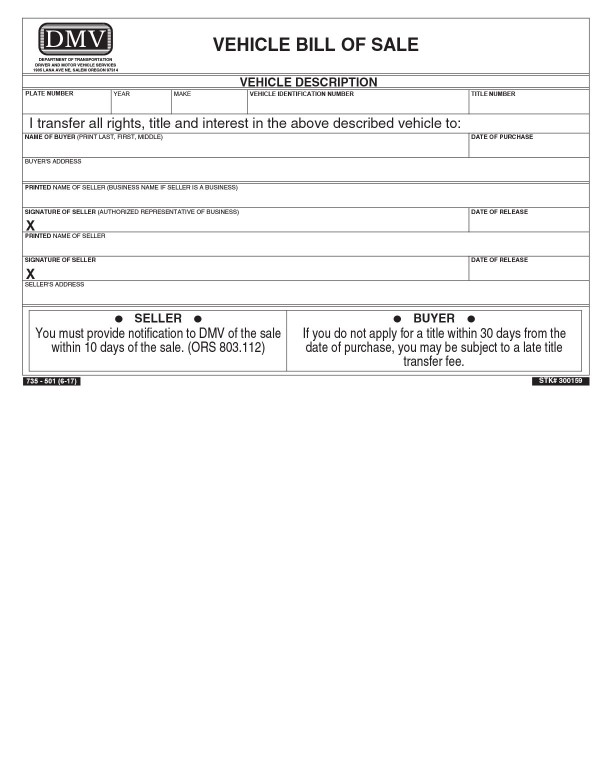

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Toyota of Naperville says these county taxes are far.

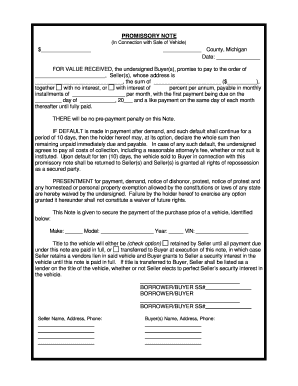

. The buyer will pay sales tax on the purchase price. As an example if you purchase a truck from a private party for 10000 then you will pay 6 of that amount to. A recent study by.

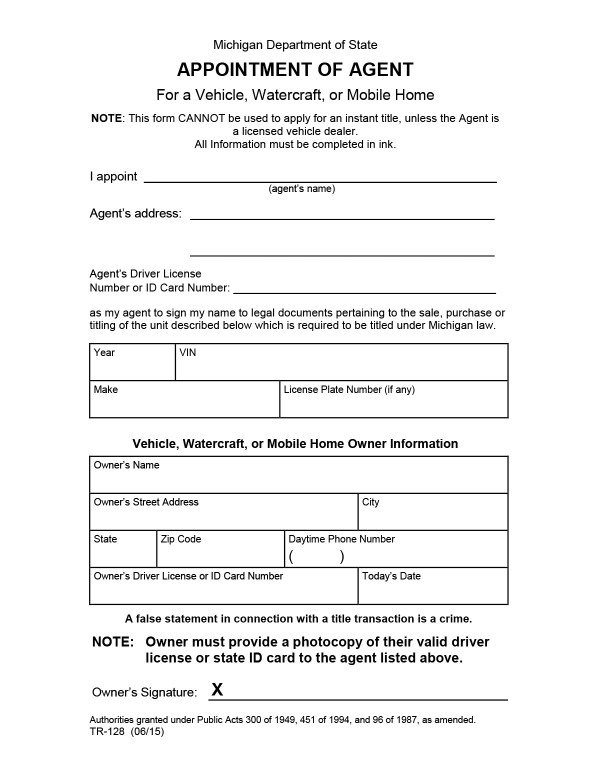

For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. Ad Receive Car Selling Tips Pricing Updates New Used Car Reviews More. In Michigan you wont have to pay any sales or use tax on a gifted car if youre a family member including spouses parents step-parents in-laws siblings children.

Ad High-Quality Reliable Form For Selling A Car Privately Developed by Lawyers. Michigan collects a 6 state sales tax rate on the purchase of all vehicles. While most services are exempt from tax there are a few exceptions.

For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the. Thats why the fact that the sales tax will go on the federal governments website next month is the most important thing happening in Washington right now. You will register the vehicle in a state with no sales tax because.

If you spend 7000 on a car and an additional 1000 on. Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged. Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts.

In addition to taxes car purchases in Michigan may be subject to other fees like registration title and plate fees. It is needed whenever you buy a car from a private seller as opposed to a dealer. A sales tax is required on all private vehicle sales in Michigan.

In the state of Michigan services are not generally considered to be taxable. Create on Any Device. Answer 1 of 9.

For example a service whos work includes. Selling a Junk Car in. The Michigan Department of Treasury.

Michigan requires a 6 use tax be paid by the seller on all private vehicle sales unless you are transferring the title to someone with a tax exempt status. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

That depends on the sate and the laws regarding sales tax. You can avoid paying sales tax on a used car by meeting the exemption circumstances which include. Selling a vehicle for a profit is considered a capital gain by the IRS so it does need to be reported on your tax return.

Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater. In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in. If you are buying or selling a car for the first time you may be unaware of how taxes are paid for this type of transaction.

It should contain important information including the purchase price of the vehicle the sale date a.

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Michigan Bill Of Sale Forms Information You Need To Create A Bill Of Sale

What Paperwork Do I Need To Sell My Car Privately Privateauto

What Do I Do With My Plates After I Sell My Car Sell My Car In Chicago

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

From Retro To High Tech Michigan Drivers Snap Up New License Plate Options Bridge Michigan

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

What S The Car Sales Tax In Each State Find The Best Car Price

How To Transfer A Car Title In Michigan Privateauto

Michigan Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

What Paperwork Do I Need To Sell My Car Privately Privateauto

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Free Michigan Bill Of Sale Form Pdf Word Legaltemplates

Michigan Laws About Private Used Car Sales

Bill Of Sale Form Michigan Motor Vehicle Bill Of Sale Templates Fillable Printable Samples For Pdf Word Pdffiller

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)